The crypto market is up today, after several days of trending mildly downwards. Nearly all of the top 100 coins per market cap have seen their prices rise over the past 24 hours. At the same time, the cryptocurrency market capitalization has remained unchanged at $3.47 trillion. The total crypto trading volume is at $120 billion, the highest it’s been in days.

TLDR:

Crypto Winners & Losers

All top 10 coins per market cap have seen their prices appreciate today.

Bitcoin (BTC) is up 2.3%, surpassing the $108,000 territory and now standing at $109,515.

Ethereum (ETH) has recorded the second-highest increase in the category of 6.1%, currently changing hands at $2,600.

The best performer is Dogecoin (DOGE), with an increase of 7.8% to the price of $0.1742.

At the same time, the smallest increase is Binance Coin (BNB)’s 0.8% to $661.

Eight of the top 100 coins saw double-digit increases. The highest among these is Bonk (BONK)’s 20.8%, trading at $0.00001738.

Yesterday’s best performer, Pudgy Penguins (PENGU), fell the most: 2.2% to $0.01533.

Recently, BONK announced that it’s nearing 1 million onchain holders, a milestone that will trigger the burn of 1 trillion BONK.

Meanwhile, BitMEX co-founder Arthur Hayes opined that BTC could fall to the $90,000 level before hitting new highs.

The market uptick follows another increase in investor interest in the space. Notably, when it comes to UK pension funds, Cartwright Pension Trusts launched an “Annual Bitcoin Review” for its institutional clients. This came after a significant discussion prompted by the company’s revelation a client had allocated 3% of their fund to BTC in November 2024 and had posted a 60% return since.

‘With Elevated Profit Levels Comes Increased Market Volatility’

Gadi Chait, Head of Investment at Xapo Bank, noted that “Bitcoin’s on-chain metrics continue to showcase the strength of its current market position.” Per Glassnode data, BTC supply in profit jumped from 87% to 98% between 22 June and 29 June. “This is significant and reinforces just how bullish recent momentum has been,” Chait says.

He continues: “With these elevated levels of profit, there often also comes a familiar pattern with digital assets: increased market volatility. Historically, when such a high percentage of supply sits in profit, the chances of profit-taking rise. That, in turn, introduces short-term market movements even when there is a broadly optimistic outlook.”

Glassnode notes that distribution remains muted, and “investors are holding through.”

US Federal Reserve funds futures put roughly a two‑in‑three chance on a first 25 bp rate cut by September after the Federal Open Markets Committee (FOMC) held rates steady in June, Chait says.

“Taken together, these factors suggest any pull‑backs are more likely to be healthy consolidations than the start of a deeper reversal. Regardless, this behavior is more a marker of a healthy, maturing market and shows Bitcoin’s growing alignment with secure and long-lasting investments that can handle global shocks while also attracting high levels of capital,” Chait concludes.

Levels & Events to Watch Next

At the time of writing, BTC trades at $109,515. Over the past day, the coin has seen a steady increase from the daily low of $106,925.

Resistance levels now stand at $109,764 and $110,809. Should it surpass both, BTC could break its ATH. At the same time, the current support level stands at $108,600.

At the same time, Ethereum is currently trading at $2,600. It was trading around $2,450 for several hours today before surging to its current price and the intraday high.

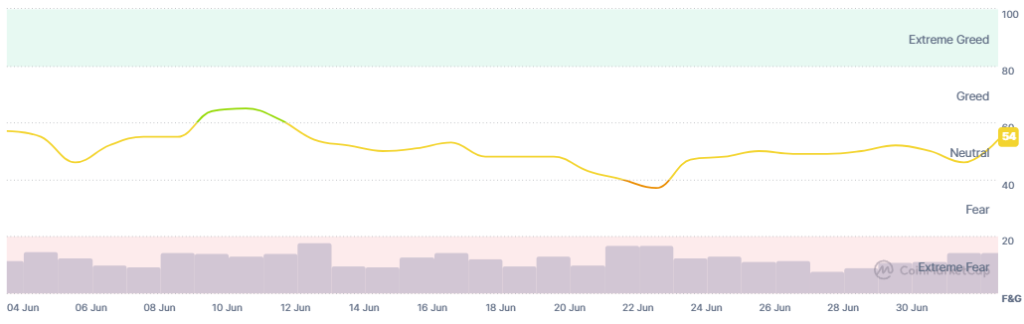

Notably, the crypto market sentiment jumped today. Even though it’s still moving within neutral territory, the Fear and Greed Index surged from 46 yesterday to 54 today. The sentiment dipped briefly towards the fear territory, but the overall optimism seems to be renewed today. That said, investors are awaiting further signals.

Moreover, US BTC spot exchange-traded funds (ETFs) resumed positive flows after breaking a 15-day streak on 1 July. On 2 July, they recorded inflows of $407.78 million in outflows. Most ETFs saw positive flows today, led by Fidelity’s $183.96 million. The day’s amount has brought the cumulative total net inflow to $49.04 billion.

However, US ETH ETFs recorded outflows today of $1.82 million. While Grayscale, Fidelity, Bitwise, and VanEck saw positive flow, BlackRock lost $46.89 million.

Notably, the first Solana staking ETF in the United States, the REX-Osprey Solana Staking ETF, launched Wednesday on the Cboe BZX Exchange. It ended the day strong, with $12 million in inflows and $33 million in volume.

On the other hand, the US Securities and Exchange Commission suddenly froze the approval of the Grayscale Digital Large Cap Fund’s conversion into an ETF, stopping its launch just a day after it had received approval.

Quick FAQ

- Why did crypto move against stocks today?

The crypto market has increased over the past 24 hours, while the US stock market saw another day of mixed performance on Wednesday. For example, the S&P 500 increased by 0.47%, the Nasdaq-100 went up by 0.73%, and the Dow Jones Industrial Average fell by 0.024%. This comes ahead of the US jobs report investors are waiting to see released on Thursday. They’re also keeping an eye on trade and US budget bill discussions.

- Is this rally sustainable?

This current uptick may not be long-lasting and may be interrupted by short-term drops, depending on the outside factors pushing down on the market. However, analysts expect the prices to climb mid-term despite potential dips.

The post Why Is Crypto Up Today? – July 3, 2025 appeared first on Cryptonews.

Arthur Hayes

Arthur Hayes