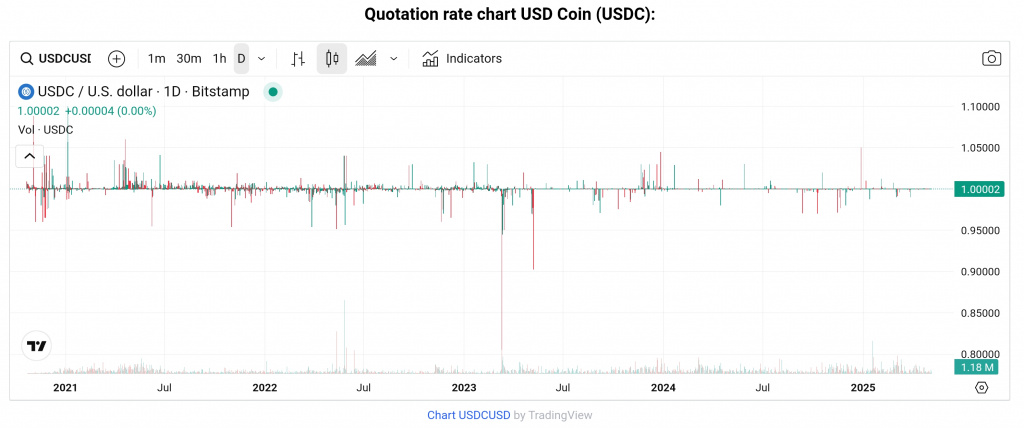

USD Coin (USDC) is a type of cryptocurrency known as a stablecoin.

USD Coin is a digital asset that is designed to have a stable value and is pegged to the US Dollar (USD) on a 1:1 basis.

USDC stablecoin

As a stablecoin, USDC is intended to maintain a stable value equal to 1 USD. This stability is achieved through the backing of each token with an equivalent amount of USD held in reserve by regulated financial institutions.

The issuers of USDC are required to undergo regular audits by independent accounting firms to verify that the total supply of USDC tokens in circulation matches the amount of USD held in reserve.

Moreover, USDC is regulated and compliant with the necessary financial regulations, providing users with an added layer of confidence regarding the stability and legitimacy of the token.

Key features

USD Coin transactions can be quickly processed on various blockchain networks, and the fees associated with sending USDC are generally lower compared to traditional banking transactions.

USD Coin is based on blockchain technology, specifically Ethereum (ERC-20), but it is also available on other blockchain networks such as Algorand (ALGO) and Solana (SPL). This interoperability allows USDC to be transferred across different blockchain ecosystems.

USD Coin is one of the many stablecoins available in the cryptocurrency market and is widely used as a way to move funds between different cryptocurrencies and exchanges while avoiding the price volatility of other digital assets. The purposes of use include: trading, lending, borrowing, remittances, and as a medium of exchange within decentralized applications and smart contracts.

Stable but not risk-free

However, it’s essential to recognize that although stablecoins are designed to be stable, they are not risk-free, and users should exercise caution and conduct due diligence before using or investing in any stablecoin.