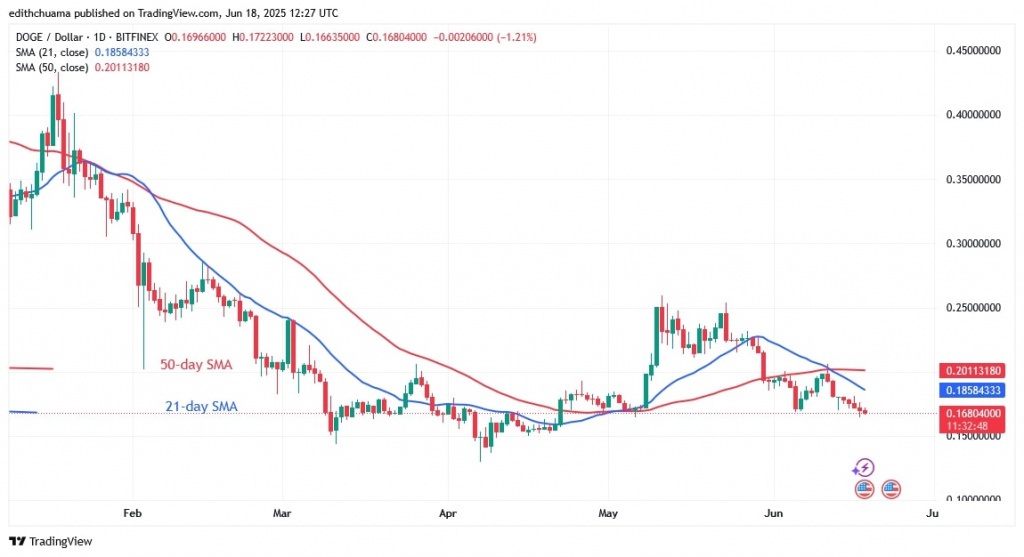

The price of Dogecoin (DOGE) has fallen below the moving average lines since June 5.

Dogecoin price long-term prediction: bearish

The cryptocurrency is hovering between the $0.16 support and below the $0.26 barrier. The bears are trying to break through the current support level at $0.16 and DOGE is on its way down. If the bears succeed in pushing the price below the current support, DOGE is likely to fall sharply to a low of $0.14.

The bearish momentum will continue to the low of $0.10 if the $0.14 support is also broken. The bulls will stop the selling pressure if they defend the $0.14 or $0.16 support. The uptrend will start above these levels. A break above the moving average lines, on the other hand, will signal the return of the uptrend. DOGE will try to reach the $0.26 level, its previous high. At the time of writing, DOGE is trading at $0.1676.

DOGE price indicators analysis

The appearance of Doji candlesticks suggests that DOGE has been bearish over the past week, albeit steadily. The moving average lines are sloping downwards, indicating a downtrend. The 21-day SMA is below the 50-day SMA, reinforcing the negative signal. DOGE has reached the oversold area of the market.

Technical indicators

Resistance Levels $0.45 and $0.50

Support Levels – $0.30 and $0.25

What is the next direction for Dogecoin?

DOGE is consolidating above the $0.16 support as the bears try to continue their downward move. The downward movement of the price was slowed down by the appearance of the Doji candlestick.

On the 4-hour chart below, DOGE is now trading above the $0.16 support and below the moving average lines. The altcoin will rise if the $0.16 support holds.

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.