Bitcoin is currently consolidating just below its $112,000 all-time high, with bulls firmly defending the $108,000 level as short-term support. This narrow range has created a tense but bullish environment as traders and investors await a decisive move that could shape the market’s direction in the months ahead.

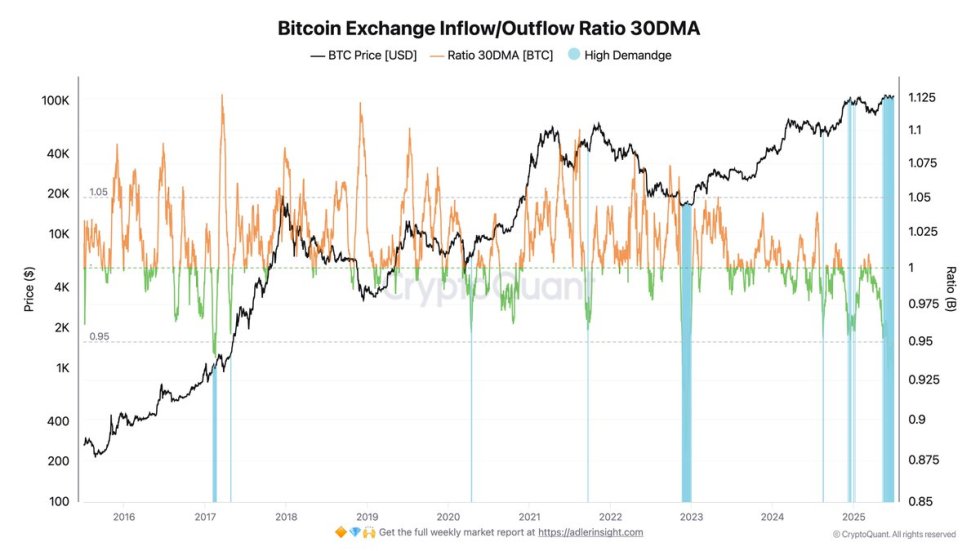

Top analyst Darkfost highlights a notable trend: outflows continue to dominate, reinforcing long-term investor confidence. This pattern suggests that rather than exiting the market, seasoned holders are moving BTC off exchanges, typically a sign of reduced selling pressure and strong conviction.

It’s not difficult to see why confidence is building. Bitcoin adoption is steadily growing among major corporations and government institutions alike. The digital asset is no longer seen purely as a speculative tool but is increasingly being positioned as a long-term store of value. From corporate treasury strategies to nation-state interest, Bitcoin is gradually becoming embedded in broader financial infrastructure.

Bitcoin Range-Bound As Long-Term Confidence Builds

Bitcoin is currently trading within a tight range between $103,000 and $110,000. This range has persisted for several weeks, creating a buildup in momentum that suggests a breakout is imminent. A decisive move above $110K could push Bitcoin into price discovery, while a breakdown below $103K would likely trigger an accelerated downside. For now, the market remains in wait-and-see mode.

Macroeconomic uncertainty is beginning to ease, with more clarity emerging around interest rate policy and global growth expectations. Many analysts believe that a new bullish phase could unfold in the coming months. Still, risks remain. US Treasury yields are climbing once again, and inflation continues to show signs of persistence—two variables that could dampen market sentiment if they worsen.

Despite these headwinds, long-term investor confidence appears strong. Darkfost notes that outflows are once again dominating the market. The monthly outflow/inflow ratio has fallen to 0.9, a level not seen since the depths of the 2023 bear market. A ratio below 1 typically signals sustained demand on the spot market, as coins are being withdrawn from exchanges rather than prepared for sale.

This behavior reflects growing conviction among long-term holders. Bitcoin is increasingly being embraced by corporations and even governments as a strategic reserve asset. It is gradually evolving into a modern-day store of value, used to bolster treasury allocations and reduce exposure to fiat currency risks.

As outflows continue and adoption grows, Bitcoin’s long-term fundamentals remain intact. The current range may only be a pause before the next major move—one that could define the trajectory of the market heading into Q3 and beyond.

BTC Consolidates Below Resistance

The 3-day Bitcoin chart shows continued consolidation just below the $109,300 resistance level, with support holding firm near $103,600. This range has defined recent price action, and the low volatility hints at an impending breakout. Notably, BTC remains well above its key moving averages—the 50 SMA at $95,655, the 100 SMA at $90,529, and the 200 SMA at $73,817—suggesting the bullish trend remains intact on the higher timeframe.

Despite repeated tests, buyers have yet to break above $109,300 with conviction. However, the series of higher lows since mid-April indicates consistent bullish pressure building beneath resistance. A breakout above the $112K all-time high would mark a major technical shift and push BTC into price discovery, with upside momentum likely accelerating rapidly.

Volume remains relatively low, indicating market participants are waiting for a catalyst to confirm direction. Until then, traders are likely watching for another retest of the lower boundary of the range or a decisive move above resistance. As long as BTC maintains its current structure and key support holds, bulls remain in control. A close above the resistance zone would set the stage for the next leg up in this bullish cycle.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.