Bitcoin is under pressure, but bears continue to fail in their attempts to break key demand levels. Despite a volatile macro backdrop driven by the ongoing Israel-Iran conflict, BTC remains firmly supported above $103,600, a crucial price floor. This resilience highlights that buyers are still defending their ground, even as fear and uncertainty dominate the broader market.

Many analysts believe that Bitcoin is setting up for a decisive move once geopolitical tensions begin to cool. The price remains stuck in a narrow range, yet continues to trade near all-time highs—a sign of strength amid chaos. Investors are waiting for clarity, with most expecting a volatile breakout once the direction becomes clearer.

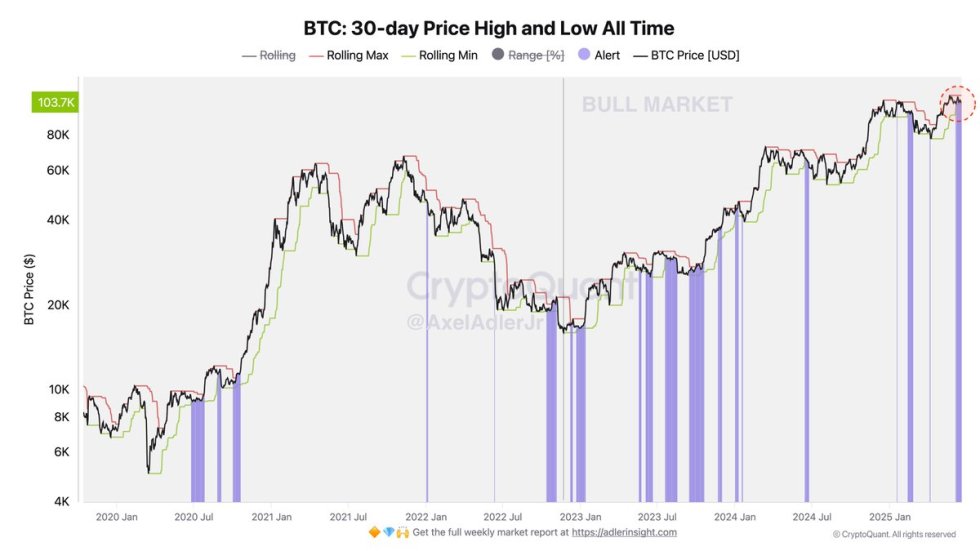

Data from CryptoQuant adds weight to this view, showing that Bitcoin is currently in a pronounced squeeze on the daily timeframe. This type of price compression typically precedes large directional moves and a surge in volatility. As the range tightens and market participants grow more cautious, a breakout—either to the upside or downside—becomes increasingly likely.

Bitcoin Consolidates As Volatility Builds

Bitcoin remains in a consolidation phase, puzzling investors with its muted price action amid mounting global tensions. Despite the geopolitical chaos and fears of broader conflict, Bitcoin’s fundamentals remain strong. Institutional adoption continues to grow, on-chain metrics show supply is steadily declining on centralized exchanges, and long-term holders remain resilient. This backdrop typically supports bullish momentum, yet BTC remains range-bound.

The situation in the Middle East has added a fresh layer of uncertainty. As hostilities between Israel and Iran escalate, the threat of US intervention looms larger. Markets are pricing in the possibility of a broader conflict that could destabilize global equities, oil, and currencies. Bitcoin has historically responded well to uncertainty, thriving during macroeconomic dislocations. However, it is still largely viewed as a risk asset. In a risk-off environment—where investors flee to cash, bonds, and safe-haven assets like gold—Bitcoin could experience sharper declines compared to traditional markets.

Top analyst Axel Adler highlights a technical setup that could be the prelude to Bitcoin’s next major move. On the daily timeframe, BTC is entering a pronounced squeeze, a pattern often followed by surging volatility. With narrowing price action and reduced momentum, Bitcoin is building pressure. If geopolitical tensions resolve or shift direction, the squeeze could result in a breakout. But if global instability worsens, especially with US military involvement, the market could pivot into a sell-off.

For now, the market appears to be waiting. Bitcoin’s direction over the coming sessions will likely depend on how the macro situation evolves and whether investor sentiment shifts toward fear or renewed optimism. Traders should watch closely—this squeeze may not last much longer.

Price Holds Steady Above Support In Tight Range

The daily Bitcoin chart shows BTC trading just below $105,000, in a tight consolidation range between the $103,600 support zone and the $109,300 resistance level. Price action continues to coil within this channel, suggesting the market is in a state of equilibrium, waiting for a clear catalyst to drive the next major move. Despite recent selling pressure, bears have failed to break below the $103,600 level—a key structure that served as the previous all-time high in December 2024.

The 50-day simple moving average (SMA) sits just beneath the current price at $104,525 and is acting as short-term dynamic support. Below that, the 100-day and 200-day SMAs remain well-structured in bullish alignment, reinforcing the longer-term uptrend. Volume, however, remains subdued, indicating that traders are hesitant to commit heavily until macro clarity emerges.

This compression in price could build into a breakout attempt, particularly if Bitcoin holds above $104K and manages to reclaim $106K–$107K levels in the coming sessions. A strong move above $109,300 could trigger another leg higher, while a close below $103,600 may open the door to further downside. Until then, Bitcoin remains in a holding pattern amid a broader backdrop of global uncertainty.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.