|

Strategy, the world’s largest Bitcoin corporate holder, has resumed its BTC acquisition. The company announced Monday it had added 155 BTC to its treasury last week, its smallest purchase since mid-March.

Michael Saylor, the company’s Executive Chairman, dropped a hint about the acquisition yesterday. When Saylor puts out the Bitcoin tracker, it is often followed by an announcement within a few days.

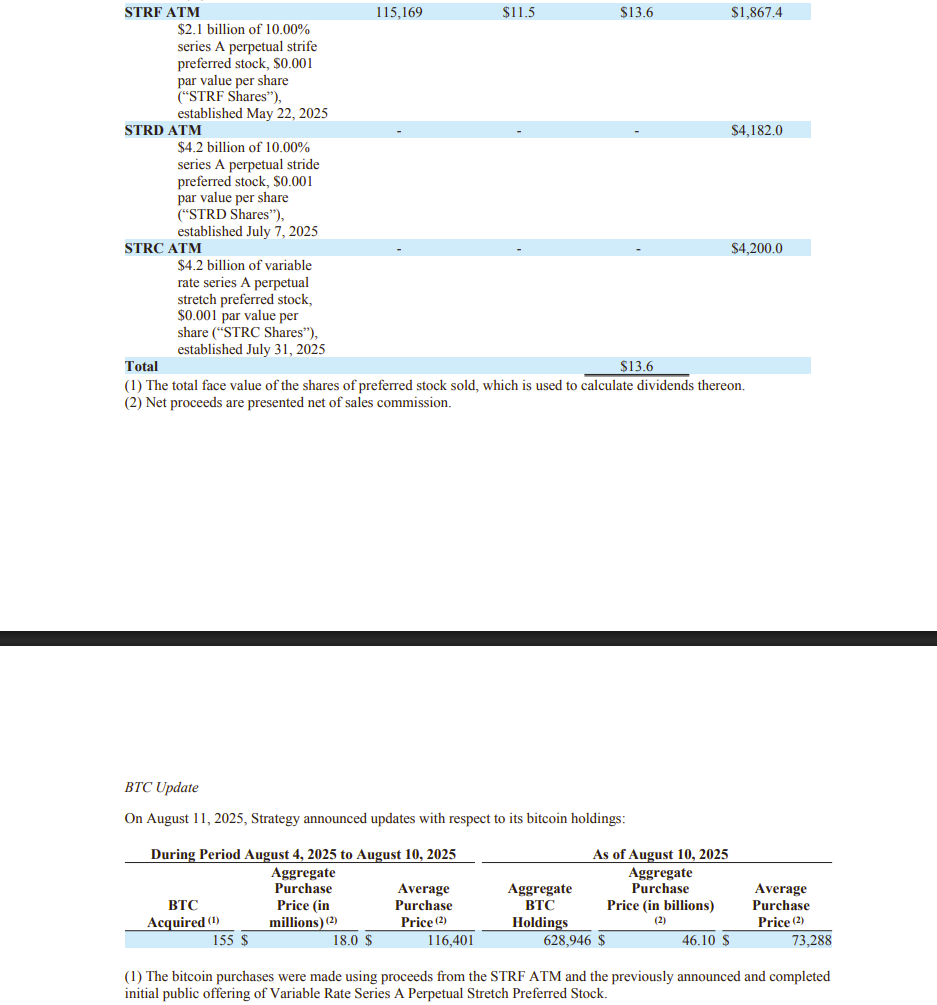

The latest purchase, disclosed in an SEC filing, was made at an average price of $116,401 per BTC. Bitcoin briefly reclaimed $122,000 earlier today, according to TradingView.

Following the purchase, Strategy’s BTC holdings have grown to 628,791 BTC. With BTC now trading at around $119,500, the stash is valued at more than $75 billion, giving the company unrealized gains of about $29 billion.

Strategy financed its latest acquisition with proceeds from selling Series A Perpetual Strife Preferred Stock (STRF) and from the completed IPO of Variable Rate Series A Perpetual Stretch Preferred Stock. Between August 4 and 10, it sold more than 115,000 STRF shares, bringing in over 13 million dollars in net proceeds.

Strategy could potentially accumulate up to 7% of the global Bitcoin supply, as stated by Saylor. However, he insists on not aiming for total dominance, emphasizing a model that promotes decentralized participation in Bitcoin.

Saylor ardently supports the growth of Bitcoin corporate adoption and the decentralization ethos of the crypto ecosystem.

Like this:Like Loading... |