The worst-performing altcoins have come under renewed selling pressure after being rejected at their overhead resistance levels.

Virtually all cryptocurrencies listed here are approaching their lows. Buyers are attracted to oversold regions of the market.

Pyth Network (PYTH)

Pyth Network (PYTH) has fallen below the moving average lines and is trying to regain its low price of $0.1050. The cryptocurrency has returned above the moving average lines but has yet to break above the $0.20 level.

PYTH was rejected twice at the $0.20 mark before falling to the bottom of the chart. The altcoin has fallen and is on the verge of hitting a low of $0.1270.

The current price: is $0.1269

Market capitalization: $729,694,570.04

Trading volume: $35,427,555.33

7– day loss: 16.73%

Story (IP)

Story (IP) is in a sideways trend but has fallen below the moving average line. Since April 4, the altcoin has traded in a narrow range of $3.50 to $5.00. The price of the cryptocurrency traded and fell between the moving average lines before being halted by the 50-day SMA. If the bears break below the 50-day SMA, IP will return to its previous low of $3.43.

However, the altcoin will rally to a high of $5.30 if it breaks above the 21-day SMA. Meanwhile, the cryptocurrency remains trapped between the moving average lines. In terms of the following parameters, the altcoin is the second worst performer.

Sonic (S)

The price of Sonic (S) has been in a sideways trend, but has fallen below the moving average lines. The altcoin has been trading in a narrow range between $0.35 and $0.65. S-coin has fallen to a low of $0.43, but may yet reach its previous low of $0.38.

Since February 3, the downtrend has reversed and risen above the $0.35 support. The bears broke through the $0.35 support once, but the bulls took advantage of the dips.

The current price: $0.4355

Market capitalization: $1,254,529,739.78

Trading volume: $84,409,735.6

7–day loss: 12.35%

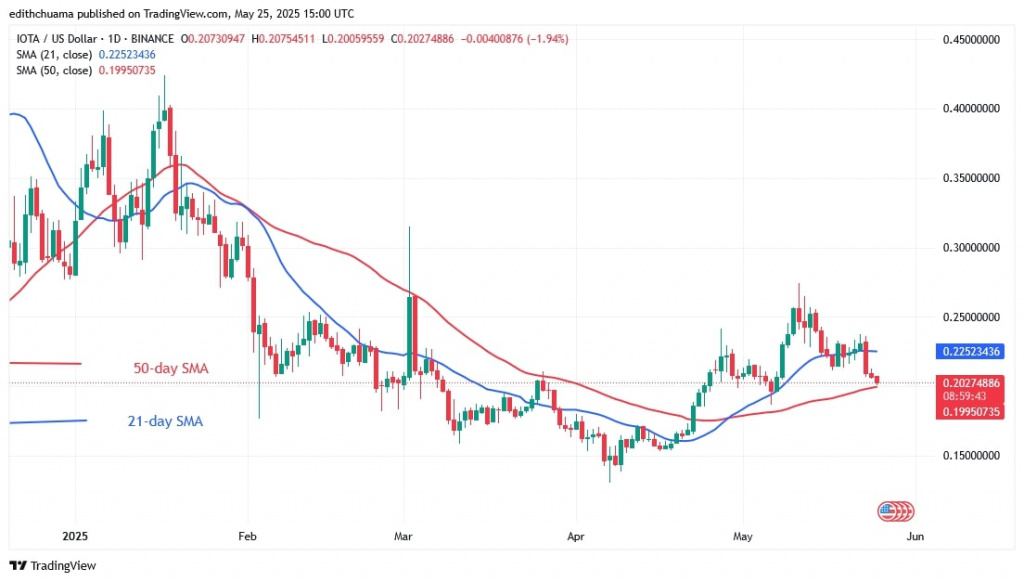

IOTA (IOTA)

The price of IOTA (IOTA) is falling below the moving average lines. In the recent price action, the altcoin recovered from its dip and reached a high of $0.27.

However, the bears have pushed the cryptocurrency below the moving average lines. The altcoin fell below the moving average lines but was stopped by the 50-day SMA. The price of the cryptocurrency is hovering between the 21-day SMA and the 50-day SMA support level. If these levels are broken, the altcoin will start to trend down. IOTA is the weakest performing altcoin in the fourth quarter.

The current price: $0.2116

Market capitalization: $800,159,531.02

Trading volume: $20,605,193.82

7-day loss: 10.98%

EOS

The price of EOS (EOS) falls below the moving average lines in a sideways pattern. The cryptocurrency has fallen below its moving average lines. The slide was halted by the 50-day SMA. In the previous price action, EOS recovered from its dip and reached a high of $0.99. Buyers were unable to sustain the positive momentum above $0.99, which led to the decline.

Currently, the price of the cryptocurrency is trapped between the moving average lines. The altcoin will perform once the 21-day SMA barrier and the 50-day SMA support are broken. EOS is the fifth worst performing cryptocurrency.

It has the following characteristics:

Current price: $0.7635

Marktkapitalisierung: $1.196.504.623,1

Trading volume: $100,477,367.4

7–day loss: 10.65%

Disclaimer. This analysis and forecast are the personal opinions of the author. They are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol.com. Readers should do their research before investing in funds.