The crypto market remains in consolidation, with the total market capitalization nearing $3 trillion, as analysts anticipate a reversal that could propel the market higher. Analysts believe that extended consolidation and negative funding rates might lead to a significant upward surge in Bitcoin, which might impact other crypto assets, with macroeconomic variables also influencing market sentiment.

Amid these expectations, Shiba Inu is attracting attention, with a 38 trillion SHIB token range in focus amid growing speculation of a potential price reversal.

Following the lackluster trading action on the market, Shiba Inu has seen declining momentum. Shiba Inu has continuously decreased after reaching a high of $0.00001525 on April 26. Shiba Inu fell for two days in a row from Tuesday but recovered in today’s trading session.

At press time, Shiba Inu was up 0.03% in the last 24 hours to $0.00001345. The rebound has brought Shiba Inu to the crucial level where 38 trillion SHIB are being held.

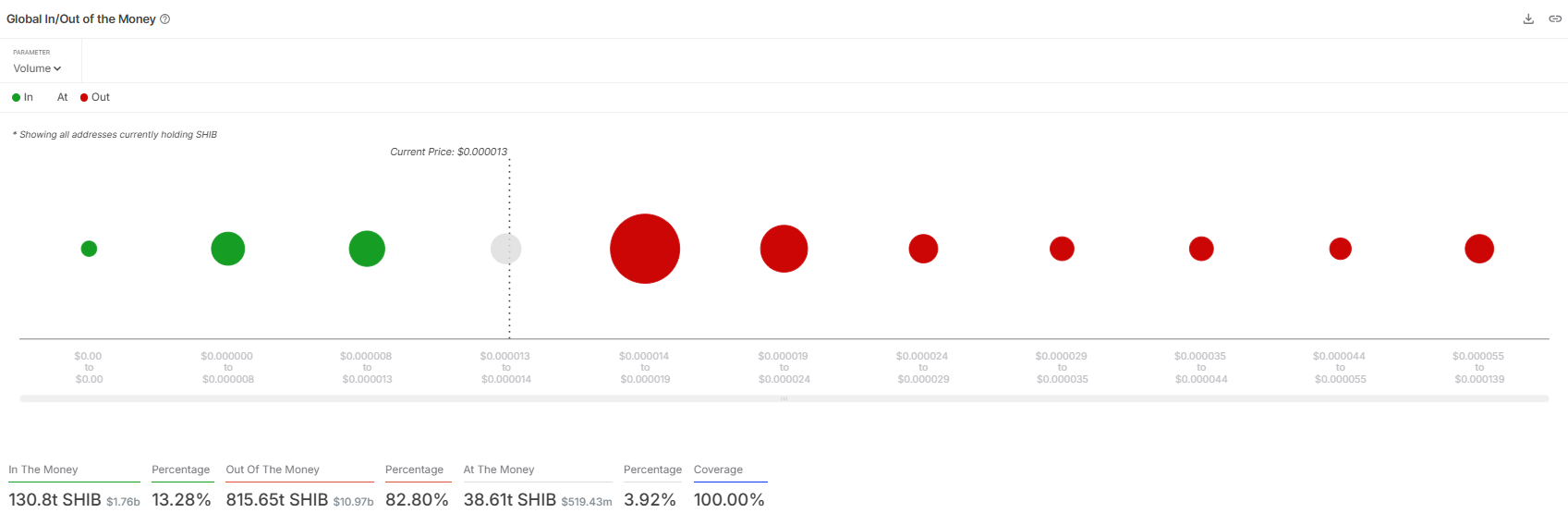

According to IntoTheBlock data, 38.61 trillion Shiba Inu tokens are being held by 55,020 addresses in the range of $0.000013 and $0.000014 at an average price of $0.000013.

Why is it significant?

The 38 trillion SHIB range between the $0.000013 and $0.000014 range is significant as it precedes a major breakout zone for Shiba Inu’s price.

Next to this range is a gigantic barrier, where 540.73 trillion SHIB were previously bought between $0.000014 and $0.000019 at an average price of $0.000016 by 157,180 addresses.

A breach beyond this range could result in greater gains for Shiba Inu and spark a new rise in its price. However, there is a risk of consolidation before a large move as the market tries to find its feet.

In the meantime, the market is closely watching SHIB’s next move, with signs pointing toward a possible trend shift.